If you want to open a branch in Spain, you should note that this is not considered a legal entity. The Spanish branch office can be registered without a share capital, as there are no requirements in this sense. Our team of specialists in company formation in Spain can offer in-depth advice on other aspects related to the Spanish branch.

| Quick Facts | |

|---|---|

| Applicable legislation |

For foreign countries |

|

Best used for |

– banking, – financial operations, – insurance |

|

Minimum share capital |

No |

| Time frame for the incorporation (approx.) |

Approx. 6 weeks |

| Management |

Local, but not mandatory |

| Legal representative required |

Yes |

| Local bank account |

Yes |

| Independence from the parent company | Dependent on the parent company |

| Liability of the parent company | Fully liable for the branch office’ obligations |

| Corporate tax rate | 25% |

| Possibility of hiring local staff | Yes |

Table of Contents

What are the characteristics of a Spanish branch office?

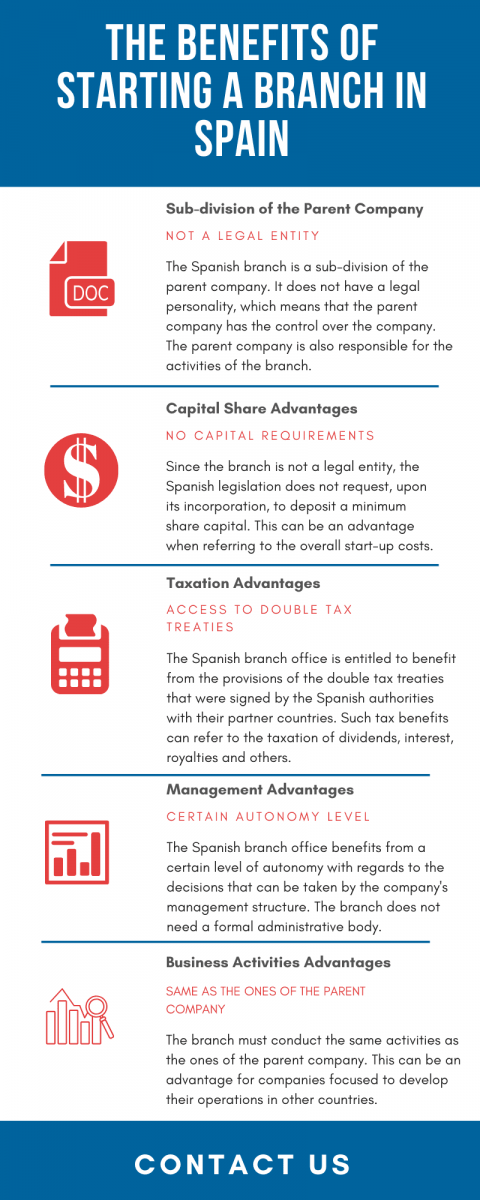

Investors who want to expand on the Spanish market through a branch office are advised to study the main characteristics of this business form to better understand the legal rights and obligations deriving from performing business activities through this structure. As a general rule, besides the above-mentioned factors, it is not necessary to establish a formal administrative body for the branch office, as a legal representative who is appointed to handle specific operations would suffice.

From a taxation point of view, the branch office is entitled to benefit from the provisions of the double taxation treaties signed by Spain with other partner countries and, in the situation in which a double tax treaty is not available, the branch will be taxed following the regulations applicable to the income of non-resident entities. Investors must consider the following characteristics when opening a branch office in Spain:

- the branch office does not have a legal personality and it is dependent on its parent company;

- the branch office benefits from a certain level of autonomy in terms of management decisions;

- the branch can start a business activity that is also carried out by the parent company;

- the structure does not have a formal administrative body and it can only appoint a local representative;

- it also needs to comply with a set of accounting requirements;

- the branch has to keep accounting documents for the activities developed on the Spanish territory.

More details on how to establish a branch in Spain are available in the video below:

What are the main requirements for the registration of a branch in Spain?

The registration of a branch in Spain is made through a public statement signed in front of a notary and it must include a set of details. All companies that want to operate as Spanish branches are required to provide the following information, as prescribed by the local legislation:

- the name of the branch (must be the same as the name of the foreign company with the termination “branch in Spain”);

- the registered office of the branch, which is a compulsory requirement regardless of the company type selected in Spain;

- the activities of the Spanish branch (must be the same as the activities carried by the foreign company);

- the representatives of the branch office and their assigned powers.

Being entirely dependent on the parent company, branches established in Spain do not have shareholders or separate administrative body, which in many cases represents a business advantage.

The official Spanish translation must be added to the above-mentioned documents and must also be stamped with the Hague Apostille. The documents must be deposited at the Mercantile Registry, which will process them in a maximum of six working days. The municipality must be notified regarding the beginning of the business activities through notification (known as declaration responsible) and our team of consultants in company registration in Spain can offer further information on this matter. If you need other types of services in this country, such as assistance in the divorce procedure in Spain, our lawyers can help you.

What are the main institutions involved in registering a Spanish branch?

When opening a company in Spain through a branch office, its representatives will have to conclude a set of steps, by providing various documents and submitting official forms to the local institutions. One of the entities that is involved in this case is the Spanish notary, where the investors will sign and legalize the necessary documents, which will then be registered with the local authorities.

In this particular case, the investors have to legalize the agreement of the parent company which states the decision to open a branch office, the company’s statutory documents (bylaws of the parent company), and other required company documents. Another necessary procedure is obtaining a Tax Identification Number, which is requested from the Spanish Tax Agency.

The investors also have to declare the foreign investment with the Directorate General for Trade and Investment, an institution operating under the Ministry of Economy and Competitiveness in Spain. The Commercial Register is also involved in the procedure of company registration in Spain, an institution where the investors need to submit the deed of incorporation.

Once the company becomes operational in Spain, any modifications brought to its structure or its statutory documents have to be disclosed to the Commercial Register. Such modifications can refer to the change of the company’s trading name, the appointment of new directors, and others. These requirements also apply if the branch office enters the liquidation procedure and any matter related to this subject needs to be filed with this institution. Our specialists in Spanish company formation can provide an in-depth presentation on the legislation referring to the dissolution of a local business.

The branch registration with the Registro Mercantile takes around 5 days but the entire process might take around 6 weeks. We mention that it is mandatory to register the branch with the social security named TGSS or Tesorería General de la Seguridad Social in Spain. One of our local specialists can manage the entire formalities for local or foreign businessmen in Spain.

What is the tax regime available for a Spanish branch in 2024?

As we presented above, the Spanish branch can benefit from the provisions of the double tax treaties signed by the local authorities, as long as there is a treaty signed with the country in which the parent company is a tax resident. In a situation in which there is no tax agreement signed with a particular country, the taxation of the branch office is done by the stipulations applicable for the taxation of income of non-resident entities. The entity should also verify the conditions for obtaining a Spanish VAT number.

In this case, the branch will be taxed based on the income obtained from commercial activities in Spain, and the general tax rate applicable in this case is 25%. Under the Spanish legislation, the income of a branch can refer to the following: the income obtained when developing economic activities, the income obtained from the assets of the branch, but also the capital gains deriving from such assets; our team of consultants in company formation in Spain can provide further assistance.

We also mention that the payments of a branch office made to its parent company on matters such as interests, royalties, technical assistance, and others do not benefit from any deductions. When repatriating the income of the branch office to its parent company, Spanish legislation stipulates that a withholding tax of 19% is applied to the respective sum.

Othe facts about branches in Spain

Please note that specific double tax treaties stipulate that the withholding tax is applicable when a branch located in Spain repatriates its income to parent companies, but the rates can be below the above-mentioned tax, as established under the provisions of the treaty (this is the case of the United States of America – Spain double tax treaty, which stipulates a tax of 10%).

Branches have clear purposes and the everyday tasks carried out from Spain. One of the advantages is that the capital transfers are made quite easy because they come from the parent company from abroad.

Our accountants in Spain can offer you complete services related to the smooth running of the business and implementing the necessary procedures. Thus, you can benefit from payroll, bookkeeping, support for audits, and the preparation of annual financial statements. Fiscal and tax advice are other aspects that come to our attention and that can be explained to you by our certified accountants. You can also ask for information about the tax-saving option you can implement in your company in this country.

The process of registration of a branch in Spain depends on the degree of accuracy of the documents and information provided to the authorities; as a general rule, it usually takes no longer than one month to register a branch office in Spain. For more details regarding this subject, investors may contact our company formation agents in Spain, who may help with further advice.